Quick Contact

Our Trusted Clients

Some of our delighted, prestigious and successfully served customers are

Over 100+ Companys Trust Us

Discover how our solutions have transformed businesses. Here’s what our clients have to say!

Empowering Your Financial Journey

We provide an Integrated Financial management System (IFMS) that streamlines management, integrating tracking, transactions, and budgeting for better cash flow and decision-making.

Providing Creative Financial Solutions to Strengthen Your Company

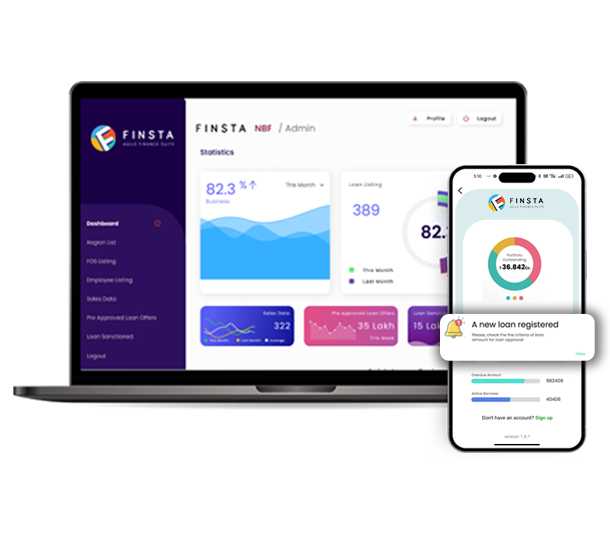

Loan Origination System

Our Loan Origination System (LOS) simplifies and automates the entire loan application process from start to finish, ensuring a seamless experience for both lenders and borrowers.

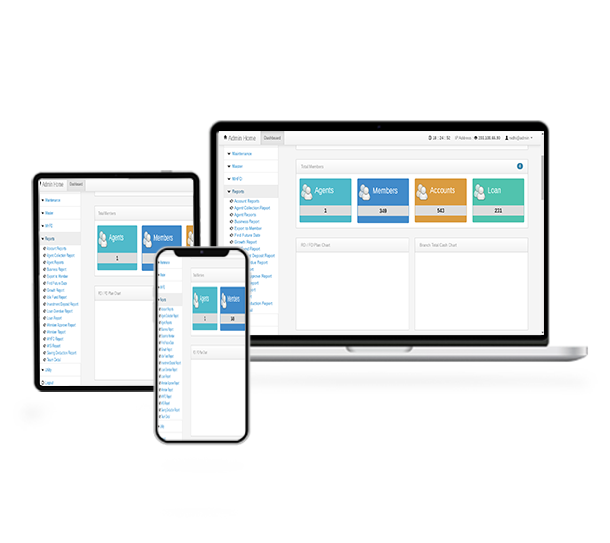

Loan Management System

Our Loan Management System (LMS) is a comprehensive solution designed to simplify and automate the entire loan lifecycle. From loan origination to post-disbursement, our system ensures seamless management of all loan processes, improving efficiency and reducing operational costs.

Loan Collection System

Our Loan Collection System is designed to optimize debt collection processes, improve efficiency, and reduce operational costs. By automating manual tasks and streamlining communications, this system ensures timely collections while improving customer relationships.

Integrated Financial Management System

We provide an Integrated Financial management System (IFMS) that streamlines management, integrating tracking, transactions, and budgeting for better cash flow and decision-making.

Get In Touch

Contact Info

Have questions or want to learn how our loan management solutions can enhance your business?

Get In Touch

Have questions or want to learn how our Fintech solutions can enhance your business?