Joint Liability Group (JLG) Software

Best Joint Liability Group Software Providers in Hyderabad

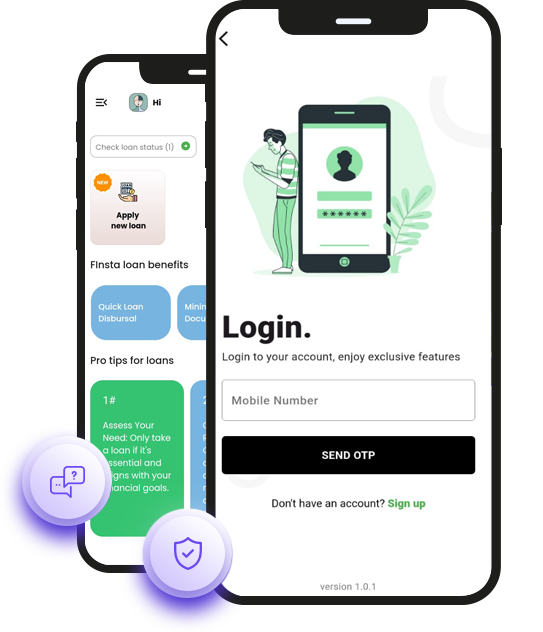

Joint Liability Group (JLG) Software by FINSTA

FINSTA’s Joint Liability Group (JLG) Software streamlines microfinance operations by managing group loans efficiently. Designed for JLG frameworks, it simplifies member tracking, loan disbursement, repayment monitoring, and reporting. With robust analytics and compliance tools, FINSTA empowers microfinance institutions to enhance transparency, reduce risk, and improve operational efficiency.

Streamline Loan Processes with Our Software Solutions

Our advanced software simplifies and accelerates the loan origination process by using an intuitive flowchart-based process design, allowing for flexible handling of various loan scenarios. This flexibility ensures that your team can adapt to changing requirements, whether they are managing personal loans, auto loans, or commercial financing.

The seamless integration with APIs enhances collaboration by enabling smooth data submission between co-lenders, streamlining information exchange, and eliminating manual intervention. This capability promotes faster decision-making and more efficient loan processing, reducing the time and resources spent on each transaction.

FAQs

Here are some frequently asked questions.

What is loan software, and how does it benefit businesses?

Loan software automates the entire lending process, from application to approval and disbursement. It improves operational efficiency, reduces manual errors, saves valuable time, and enhances decision-making capabilities.

Can your loan software integrate with our existing systems?

Yes, our software is designed to integrate seamlessly with other systems and third-party applications. It allows smooth data exchange with platforms like credit bureaus, accounting systems, and financial tools.

Do you offer training to staff for effective software use?

Yes, we provide thorough training programs for your staff, covering everything from basic functionality to advanced features. Our training ensures your team is fully equipped to use the software efficiently and effectively.

How secure is your loan software, and what safeguards exist?

Our loan software utilizes advanced encryption, strict access controls, and regular security updates to ensure the highest level of protection for sensitive customer data and to comply with industry security standards.

What customer support do you offer for your loan software?

We offer comprehensive customer support through various channels, including email, phone, and live chat. Our dedicated support team ensures timely assistance to address any issues or questions you may have.

How often is your loan software updated, and are updates free?

Our loan software is regularly updated to improve system performance, introduce new features, and address any security vulnerabilities. All updates are included with your subscription, ensuring no additional costs.