Core Banking System Applications in 2025: Emerging Trends and Technologies

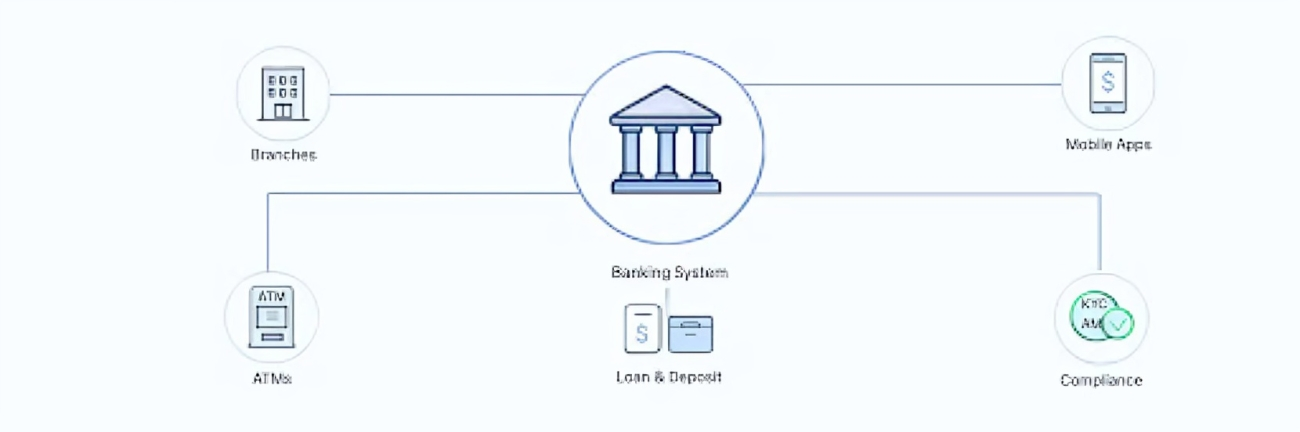

The banking sector is undergoing a massive transformation in 2025, driven by technological advancements and changing customer expectations. Core banking software has become the backbone of modern financial institutions, enabling seamless operations, improved customer experiences, and enhanced digital services. Banks now require robust core banking solutions to stay competitive and cater to the growing demand for mobile and online banking applications.

With innovations ranging from AI-driven analytics to cloud-based platforms, the future of core banking system applications promises flexibility, efficiency, and innovation. Let’s explore the key trends shaping core banking software and why financial institutions are increasingly adopting advanced solutions.

1. Cloud-Based Core Banking Software

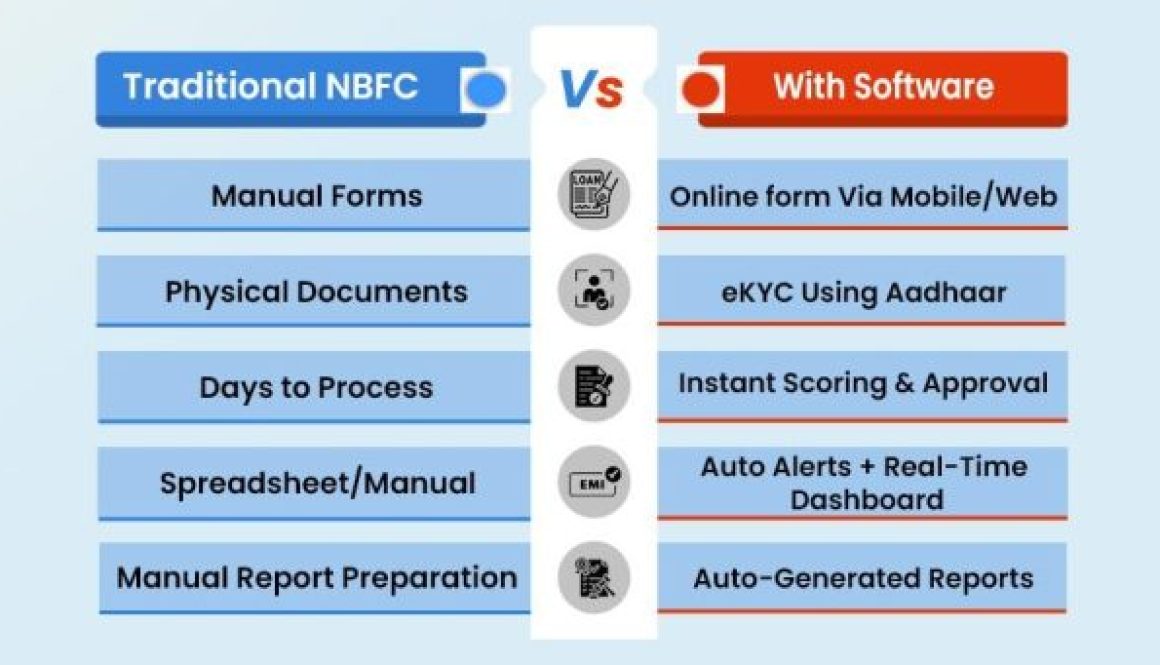

One of the most significant shifts in 2025 is the adoption of cloud-based core banking software solutions. Cloud deployment offers scalability, cost-efficiency, and accessibility that traditional on-premise systems cannot match. Banks can now implement mobile core banking solutions without heavy infrastructure costs, making it easier to introduce new services to customers.

Benefits of cloud-based core banking software:

- Reduced IT maintenance costs

- Faster software upgrades and deployment

- Enhanced security and disaster recovery

Banks leveraging cloud solutions are also able to offer online mobile applications for core banking, enabling customers to manage accounts, transfer funds, and access services anytime, anywhere.

2. Artificial Intelligence and Data Analytics

AI and advanced data analytics are becoming integral components of modern core banking solutions. Core banking software providers are integrating AI algorithms to enhance fraud detection, predict customer behavior, and personalize banking services.

Key applications of AI in core banking system applications:

- Automated loan approvals using predictive analytics

- Personalized financial recommendations for customers

- Chatbots and virtual assistants for instant customer support

With AI-powered mobile core banking solutions, banks can provide highly customized experiences on online mobile applications for core banking, strengthening customer loyalty and engagement.

3. Mobile-First Banking Solutions

Mobile banking continues to dominate as customers increasingly prefer accessing services via smartphones. Banks now prioritize mobile core banking solutions to offer seamless transactions, real-time account management, and digital payments.

Advantages of mobile core banking software:

- Real-time transaction alerts

- Instant fund transfers and bill payments

- Easy integration with digital wallets and UPI

Offering robust online mobile applications for core banking ensures customers enjoy convenience, speed, and enhanced security, making it a crucial trend in 2025.

4. Open Banking and API Integration

Open banking is transforming the way banks interact with third-party service providers. Core banking software solutions now come with API integration capabilities, allowing banks to collaborate with fintechs and other digital service providers.

Impact of API-enabled core banking system applications:

- Access to a broader range of financial services

- Streamlined onboarding for new customers

- Enhanced innovation in payment and lending solutions

Through these integrations, banks can create richer digital experiences for customers while maintaining control over their core banking systems.

5. Enhanced Security and Compliance

As digital banking grows, cybersecurity and regulatory compliance have become top priorities. Modern core banking software providers are focusing on secure platforms with multi-layered protection against cyber threats.

Security features in core banking software solutions:

- End-to-end encryption for mobile and online banking apps

- Biometric authentication for secure logins

- Continuous compliance with global banking regulations

Ensuring robust security in mobile core banking solutions and online mobile applications for core banking builds trust among customers, a critical factor for long-term success.

6. Blockchain and Digital Ledger Technology

Blockchain technology is gradually entering core banking system applications, especially for cross-border transactions, smart contracts, and fraud prevention. Banks are exploring blockchain integration to enhance transparency, reduce processing time, and minimize transaction costs.

Benefits of blockchain in core banking:

- Instant international fund transfers

- Secure and transparent transaction records

- Reduced dependency on intermediaries

By integrating blockchain into core banking software solutions, banks can offer next-generation digital services through online mobile applications for core banking, making transactions safer and faster.

7. Personalized Customer Experiences

Customer-centricity is driving innovation in core banking software. Banks are moving beyond generic services to provide highly personalized banking experiences. From AI-driven insights to tailored product recommendations, personalization is redefining banking engagement.

How core banking system applications enhance personalization:

- Customized financial dashboards

- Real-time spending insights

- Targeted offers and rewards

With advanced mobile core banking solutions, banks can ensure customers feel valued, boosting retention and satisfaction.

Conclusion

The evolution of core banking software is shaping the future of financial services in 2025. From cloud computing and AI to mobile-first applications and blockchain, modern core banking system applications are enabling banks to deliver faster, safer, and more personalized services.

For financial institutions looking to stay ahead, choosing the right core banking software provider is essential. Among the various options available, Finsta’s core banking product stands out as the best in India to buy, offering comprehensive solutions, mobile integration, and advanced innovations that cater to both banks and their customers.

Investing in the right core banking software solutions today will not only streamline operations but also set the stage for long-term growth in the digital banking era.

Try Before You Decide — Free Demo Available! – https://finsta.in/contact-us/