In today’s digital banking era, customers expect instant, secure, and seamless access to their banking services. Whether through mobile apps or branch visits, they demand consistent and responsive service. Finsta’s Core Banking Solution is built to meet these expectations with ease. It centralizes your banking operations under one robust platform, improves staff efficiency, and enhances customer satisfaction. With real-time connectivity across all branches and digital channels, you get unified control of every transaction. Finsta ensures your organization runs smarter, faster, and more efficiently all while staying fully compliant with regulations.

What Is a Core Banking Solution?

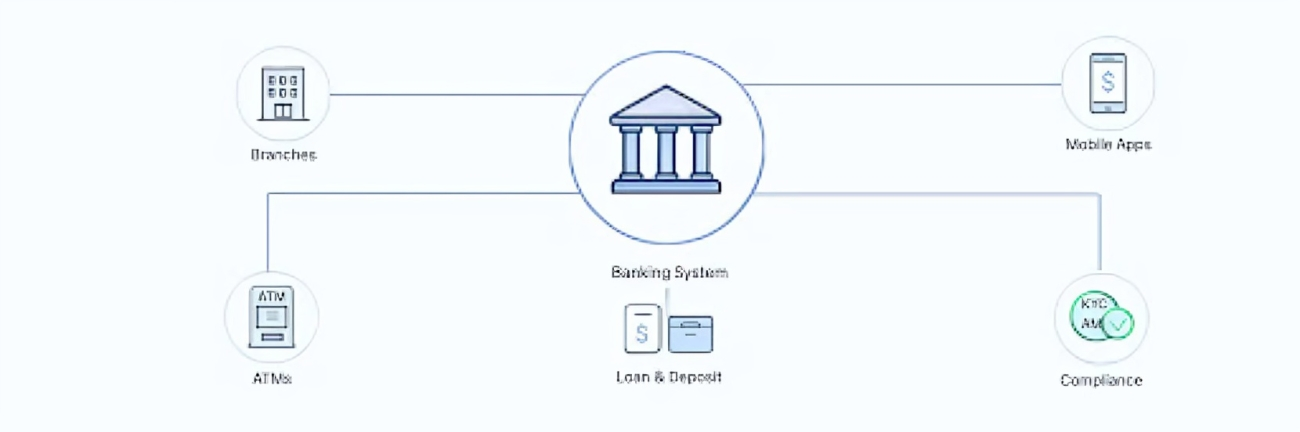

A Core Banking Solution (CBS) is a centralized software system that handles all the essential operations of a bank from customer account management to deposits, withdrawals, loans, and payments. It connects all branches and digital platforms in real time, ensuring seamless banking across channels.

Why Do Banks Need a Core Banking Solution?

Without a unified system, managing accounts across multiple branches becomes complex, time-consuming, and error-prone. A core banking solution eliminates silos, automates repetitive tasks, and ensures that customers get consistent service — whether they visit a branch, use an app, or contact support.

Top Features of Finsta’s Core Banking Platform

- Real-Time Transaction Processing

Every transaction reflects instantly across branches and platforms. - Centralized Data Management

All customer and account data is securely stored in one place. - Multi-Branch & Multi-User Access

Easily scale across locations while maintaining complete control. - Loan & Deposit Automation

Streamlined lending and deposit tracking with built-in workflows. - Regulatory Compliance Tools

Inbuilt KYC, AML, and audit support to help meet banking standards. - Role-Based Access Control

Secure login with customized permissions for staff and departments.

Role of Core Banking in Today’s Generation

In this fast-moving generation, customers expect their bank to be accessible 24/7, from any device. Core banking solutions play a vital role in meeting this demand. They enable banks and NBFCs to provide digital-first experiences without sacrificing security or speed. Services such as instant money transfers, online loan applications, and automated alerts are made possible through CBS. Additionally, it allows institutions to track data trends and customer behavior for smarter decision-making. With digital competition rising, having a CBS gives your bank a competitive edge and ensures it stays relevant to modern users.

Modern customers expect banking without boundaries. A strong CBS allows banks and NBFCs to:

- Offer 24/7 access through digital channels

- Provide faster service through automation

- Analyze data for better decision-making

- Launch new financial products with ease

Key Benefits of Using Finsta’s CBS

Finsta offers more than just software, it’s a strategic partner for banking transformation. With anytime-anywhere banking access, your customers never have to wait in queues or face downtime. Automation significantly reduces human errors and operational costs. Loans are processed faster with built-in workflows, and staff can generate reports instantly with just a few clicks. Finsta also prioritizes security, ensuring every transaction meets bank-grade safety protocols. Its scalable architecture means you can start small and expand as needed — making it ideal for financial institutions at any growth stage.

- Anywhere, Anytime Banking

- Reduced Manual Work & Errors

- Quick Loan Disbursal & Processing

- Bank-Grade Security Standards

- Actionable Analytics & Reporting

- Cost-Effective & Scalable Platform

Whether you’re a cooperative society, NBFC, microfinance firm, or urban bank Finsta helps you deliver modern banking with ease.

Future Trends in Core Banking

The future of core banking is all about innovation and connectivity and Finsta is already prepared. Integration of AI and machine learning will soon automate loan approvals, detect fraud patterns, and personalize customer experiences. Open banking, enabled by APIs, will allow seamless collaboration with third-party apps and fintech services. Cloud-based deployment is becoming the norm, offering flexibility, speed, and lower IT infrastructure costs. Mobile-first design ensures that even customers in remote locations can access banking with ease. Finsta constantly evolves to keep you ahead of the curve in this rapidly

Finsta keeps evolving with the latest innovations. The future of core banking includes:

- AI & Machine Learning Integration

Predictive insights, automated approvals, and fraud detection. - Open Banking & API Connectivity

Seamless integration with third-party fintech apps. - Cloud-Based Deployment

Fast, scalable, and low-cost infrastructure. - Mobile-First Design

Optimized for smartphones and tablets to serve rural & urban customers alike.

Who Can Benefit from Core Banking?

Finsta’s CBS is perfect for:

- Cooperative Banks & Societies

- NBFCs & Microfinance Institutions

- Nidhi Companies & Credit Co-ops

- Fintech Startups Offering Lending Services

If you’re managing customers, accounts, or loans, a core banking solution is essential for smooth operations and regulatory compliance.

Why Finsta Is the Right Choice

- Tailored for Indian Financial Institutions

- Proven Track Record Across 450+ Clients

- User-Friendly Interface for Non-Tech Users

- Dedicated Support Team for Setup & Growth

- All-in-One: Loan, Accounting, Reporting, Compliance

Finsta’s Core Banking: Your Bank’s Digital Backbone

The future of core banking is all about innovation and connectivity — and Finsta is already prepared. Integration of AI and machine learning will soon automate loan approvals, detect fraud patterns, and personalize customer experiences. Open banking, enabled by APIs, will allow seamless collaboration with third-party apps and fintech services. Cloud-based deployment is becoming the norm, offering flexibility, speed, and lower IT infrastructure costs.

Mobile-first design ensures that even customers in remote locations can access banking with ease.

Finsta’s Core Banking Software is already trusted by over 450+ clients across India. Its simple interface, strong customer support, and wide range of features make it ideal for both tech-savvy and non-tech users. From opening accounts to managing loans and reports — everything happens in one place. If you’re looking for a reliable, cost-effective, and future-ready core banking system, Finsta is the perfect choice for your financial business.