Transform Your NBFC Operations with Finsta

Experience seamless loan management, compliance, and growth with Finsta’s powerful NBFC software solution. Start optimizing your business today!

Quick Contact

Our

Trusted Clients

What is NBFC Software?

NBFC Software is a financial tool designed for Non-Banking Financial Companies (NBFCs). It streamlines loan management, deposit tracking, account management, and compliance. Features include EMI calculations, payment tracking, financial reporting, and agent commission tracking. It ensures regulatory compliance and operational efficiency while supporting scalability.

Key Features of Finsta’s NBFC Software

Finsta’s NBFC software is tailored to meet the needs of Non-Banking Financial Companies, providing a range of essential feature

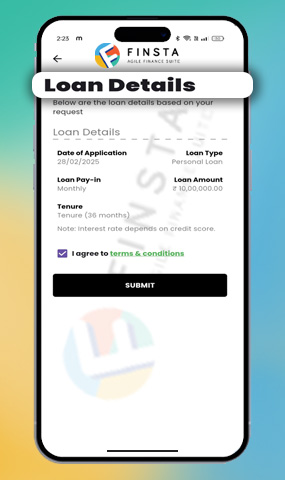

Comprehensive Loan Management

Fully Web-Based Functionality

Accurate Penalty Calculations

Installment and Payment Tracking

Policy and Due Installments

Detailed Monthly Statements

Agent Commission Reporting

User-Friendly and Powerful Tools

Industries That Benefit from Finsta NBFC Software

Ideal for Nidhi Companies, Credit Societies, NBFCs, and Microfinance firms, Nidhi Software streamlines operations and ensures compliance.

Why Choose Us

What Sets Finsta’s NBFC Software Apart?

Customization

Scalability

Regulatory Compliance

Efficiency

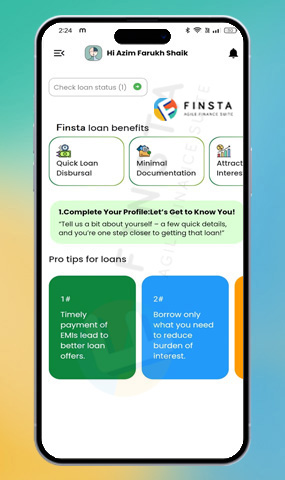

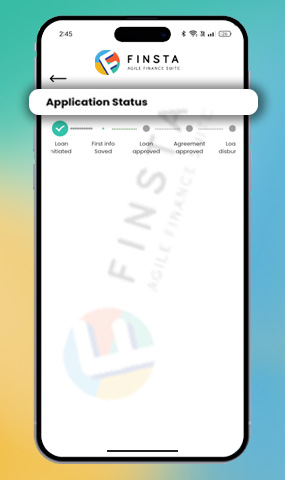

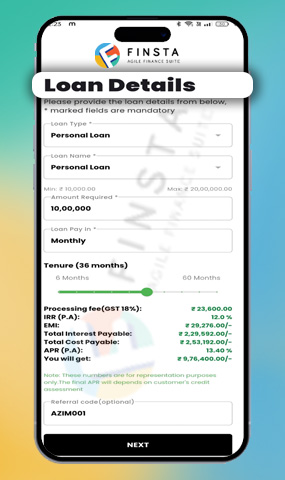

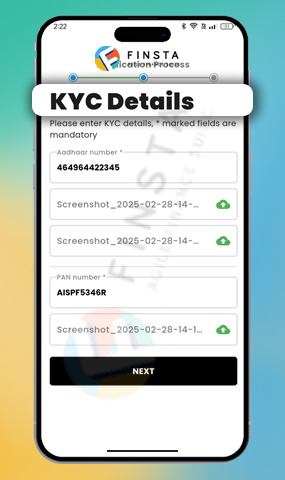

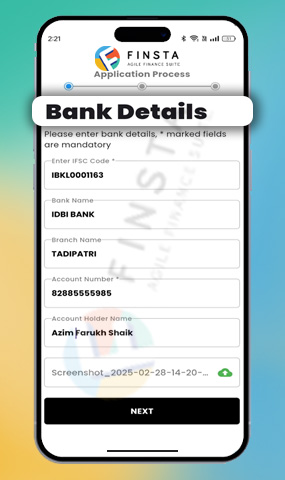

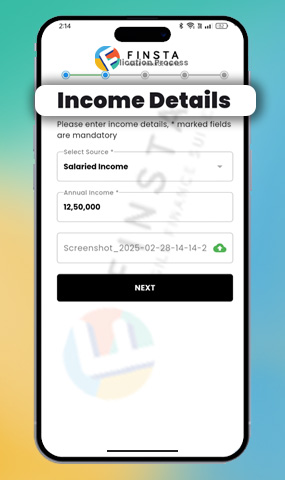

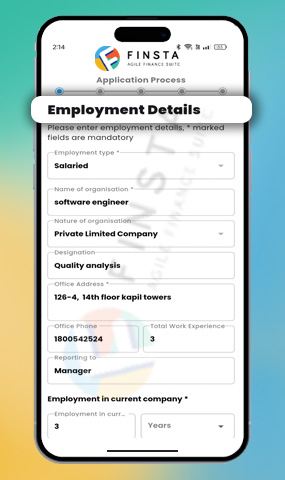

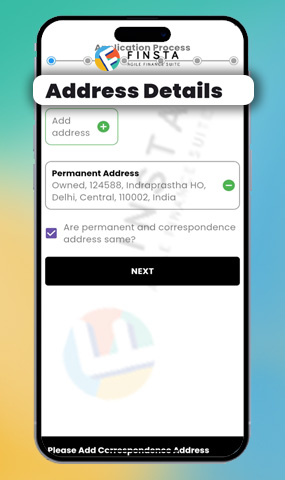

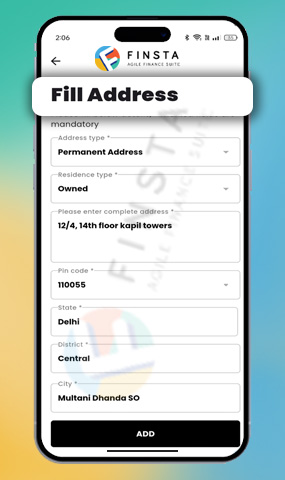

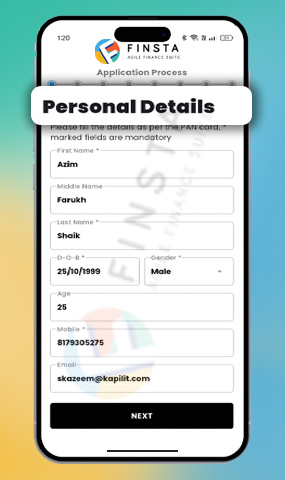

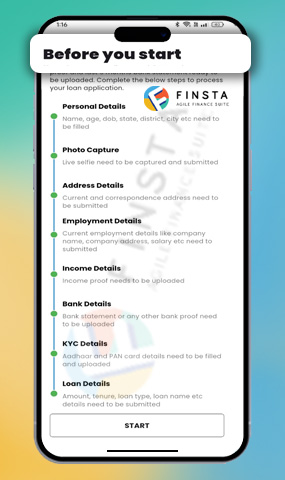

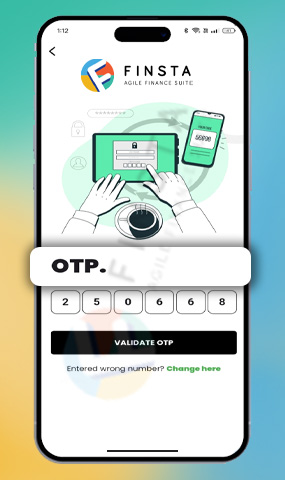

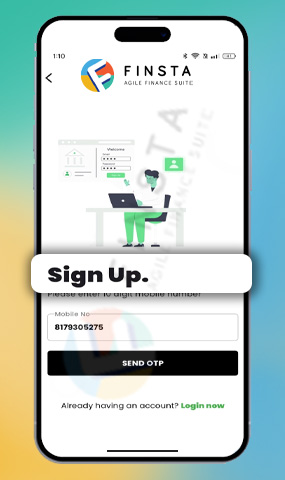

How Our App Works?

Ready to Simplify Your Loan Process?

learn how our system can help you streamline your operations and

improve customer satisfaction.